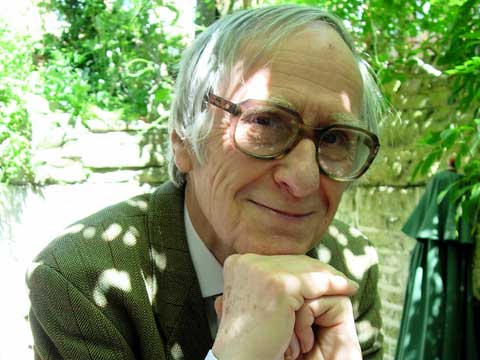

by David Fleming and Shaun Chamberlin

This originally appeared in Local Futures

What follows are some excerpts from the late David Fleming’s Lean Logic: A Dictionary for the Future and How to Survive It (Chelsea Green Publishing, 2016). The excerpts have been chosen by the book’s editor, Shaun Chamberlin. Extensive references are given in the dictionary itself, but are omitted here.

Localisation. Localisation stands, at best, at the limits of practical possibility, but it has the decisive argument in its favour that there will be no alternative.

Does that mean the end of travel? On the contrary, it means the end of mass dislocation – and the recovery of place. Almost wherever you go in the market economy, you find yourself in the same place – in the globalised market with its shared banality, its fullness; at the end of every lane is a busy road and a housing estate like the one at the beginning of it. You cannot get out of a globalised world, because there is no out. Localisation means the protection of distinctiveness: when you are out, you are somewhere else, in a different in.

Travel now finds its purpose, taking you to a place which is not in essentials identical to the one you have left, but to one that is interesting and finds you interesting, that wants to hear your song, that dances to a different tune.

See also: Delocalisation, Local Wisdom, Presence, Scale

Needs and Wants. A distinction between needs and wants has been made by many critics in the green movement and its predecessors, who have argued that consumption in response to our needs is justifiable and sustainable, but consumption in response to our wants is not.

Yet this notion that needs are good and wants bad does not survive inspection. For the anthropologists Douglas and Isherwood, it is a “curious moral split [that] appears under the surface of most economists’ thoughts on human needs”. Lean Logic argues that those economists have it somewhat back-to-front.

The heaviest burden of the modern economy, by far, is that imposed by its own elaborations. Any large-scale economy requires massive infrastructures and material flows just to support itself and keep existing. Such sprawling industrial economies have massively multiplied our needs, our ‘regrettable necessities’. Regardless of whether we want them, we need the sewage systems, heavy-goods transport, police-forces… Given the substantial scale of the task of feeding, raising and schooling a suburban family, and the increasing challenge of such routine needs as finding a post office, many of us undoubtedly need cars. The collapse of local self-reliance was both the cause and the effect of the massive elaboration of transport, and when that need can no longer be met, its life-sustaining function will be bitterly recognised.

It is, then, the elaboration of needs by large-scale industrial life that causes the trouble. Our wants are squeezed-out, much-missed and light by comparison, not least because they often involve labour-intensive crafts and services – pianists, craftsmen, dress-makers, waitresses, gardeners with minimum environmental impact. Some wants are also needs, of course, and they cannot be cleanly separated, but if we focus our efforts on finding a way, under the stresses of the climacteric, of achieving a substantial and rapid liquidation of our needs, we will be getting somewhere.

See also: Growth, Intentional Waste, Invisible Goods, Lean Economics, Scale, Slack

No Alternative, The Fallacy of. (1) The fallacy that there is no alternative (but you may not have looked hard enough). (2) The fallacy that, because there is no alternative to the particular strategy that is being discussed, that strategy must be feasible. Example: It is argued that the other big energy options are not going to provide solutions in the future, and that therefore the solution is a vast expansion of nuclear energy. But this is a non sequitur: the lack of feasibility of the other options tells us nothing about whether an expansion of nuclear power is feasible or not.

Peasant. A person practicing small-scale, mixed, energy-efficient, fertility-conserving farming designed chiefly for local subsistence. It is integrated into local culture. It is the defining practice of the community. This model of farming, however, became briefly obsolete in the market economy, with its abundant cheap energy, enabling a different one to develop which did not need to supply its own energy and sustain its own fertility.

Peasant farming is a skilled and efficient way of sustaining food production within the limits of the ecology. It is an eco-ethic, sustaining the measured synergy with nature that we find in Tao philosophy. It has the five properties of resilience.

But it has a flaw. It is highly productive, so it yields a surplus, and this is a tempting resource for the gradual evolution of an urban civic society, with its unstoppable implications of growth, hubris and trouble. Is there a way of learning from that dismal cycle, and sustaining, instead, a localised, community-based, decentralised society, without the seeds of its own destruction…?

Place. Space whose local narrative can still be heard, and could be heard again, given the chance. Place is the practical, located, tangible, bounded setting which protects us from abstractions, generalities and ideologies and opens the way to thinking as discovery. On this scale, there is elegance, and some relief from the need to be right, for if you are wrong, the small scale of place allows for revision and repair, supported by conversation.

Place is the endangered habitat of our species.

See also: County, Harmless Lunatic, Home, Identity, Localisation, Parish, Practice, Proximity Principle, Regrettable Necessities, Scale, Transition

Protection. The act of caring for something that you value, or for which you are responsible – it is a deep behaviour which, in some senses, is shared by all living things. It is widely supposed to be a good thing, except in the case of economies, which are required to dance to the single tune of perpetual competition. True, natural selection is a condition of all living things, too. But species with less intelligence than ours use both. It is time we caught up.

Lean Economics is about protecting the right of local economies to proceed on a different basis.

On such matters, market economics is far from neutral. It takes the view that the competitive market is the only sound basis for economy, politics and culture, and it advocates its case with evangelical conviction: if there is a society somewhere which is not based on the market, it needs to be saved.

In a taut, competitive, growing market, it is true that protectionism is not a good idea. …

But, of course, there are circumstances in which free, unprotected trade is not what an economy needs, and we are coming to a time when they can be discussed without inviting derision. Competitive free trade comes with a commitment to growth, i.e. to the rubbing out of diversity and local self-reliance, to resource-depletion, pollution, the loss of social capital and resilience – and eventual collapse. It is too late to consider protection against these things; the damage has already been done. But protection of what is left of indigenous food production and steps toward local self-reliance and reduced dependence on fossil fuels for every aspect of food production would be rational.

See also: Local Currency, Nation

System-Scale Rule. The key rule governing systems-design: large-scale problems do not require large-scale solutions; they require small-scale solutions within a large-scale framework.

Time, Fallacies of.

The Permanent Present. The fallacy which gives undue emphasis to the present when considering an option with long-term consequences. Examples include arguments that our present ability to import food justifies permanent burial of agricultural land under new housing, that joining the Eurozone is justified by today’s low interest rates there, that the state of the jobs market at the moment calls for migrant labour, that the current price of oil opens the way to a long-term expansion of air travel. This presumption of a constant present is a leading symptom of the dementia that afflicts the judgment of governments – dementia absens: the patient is so elevated, so far removed from ordinary life, so taken up with a global vision, so protected by experts, so busy, so short of sleep, and so absent, that he or she has no sense of time or place. (Abstraction, Presence).

And there is a risk that the values of the present may crowd out all other values. The question, “What is right?”, short-circuits to the answer, “Whatever is now”.

The Irrelevant Past. An argument that affirms that now is a special case in that the present has achieved standards of reason and ethics which have not been available before. The fallacy typically cites the fact that this is the twenty-first century as proof that the argument is correct:

“By the end of the 20th century, the independent sector had emerged pre-eminent in the British education system but the only vision the independent sector has today remains entrenched in the 20th century… We need new vision for the independent sector in the 21st century… It is no longer tenable in 2008 to retain 20th century apartheid thinking.” (Anthony Seldon (2008), “Enough of this Educational Apartheid”.)

The Irrelevant Past argument begs the question: if the proposal would change things around from how they were in the past, it is self-evidently a good thing.

Here is the scientist-philosopher Mary Warnock being sympathetic with the unfortunates who are so stuck in the past that they are opposed to genetically-modified crops:

“[For] many confused and vaguely frightened people, the new biotechnology seems to have opened up possibilities of changing the genes of plants and animals in a way which nature, or God as the Creator, never intended. … [And now] the argument has moved on [to] the myth of an unnatural creature being formed in the laboratory whose growth and behaviour could not be controlled. It was upon such fears that Mary Shelley played, as long ago as 1818, in her story of Frankenstein.”

Oh dear. Perhaps we should learn from the future?

See also: Feedback, Systems Thinking

Transformation, The Great. The Great Transformation has already happened. It was the revolution in politics, economics and society that came with the market economy, and which hit its stride in Britain in the late eighteenth century. Most of human history had been bred, fed and watered by another sort of economy, but the market has replaced, as far as possible, the social capital of reciprocal obligation, loyalties, authority structures, culture and traditions with exchange, price and the impersonal principles of economics.

Unfortunately, the critics of economics have had a tendency to discuss the whole structure as a tissue of misconceptions. It is a critique that fails. The strength of economics is its considerable, if far from complete, understanding of the flows and comparative advantages that underlie trade, jobs, capital and incomes, and the logic of optimising behaviour, all backed by glittering accomplishment in mathematics. That makes it a powerful analytical instrument, so that just a few misconceptions – such as a failure to understand the informal economy or resource depletion – can have leverage: like a baby monkey at the controls of a Ferrari, they can turn it into an instrument with extraordinarily destructive potential. If it were a tissue of errors, it would not be dangerous: it is its 90 percent brilliance which makes it so.

Economics has therefore been seductive. The market economy is effective for sustaining social order: the distribution of goods, services and other assets is facilitated by buying and selling, supporting a network of exchange to which everyone has access. It provides suppliers with the incentive to know their markets and respond to them; it uses ‘pull’ rather than top-down regulation, and it learns from experience, so it is effective and efficient. It supports a more egalitarian society than any other large-scale state has been capable of and it saves a great deal of trouble: it has appealed to minds glad of a cognitive technology which enabled them to make decisions according to mathematical models, and with little fear of contradiction.

“Douce commerce”, sweet commerce, wrote Jacques Savary, an early management consultant, in a textbook for businessmen (1685), “makes for all the gentleness of life.” The authorities themselves agreed: commerce is the most “innocent and legitimate way of acquiring wealth”, observed an edict of the French government in 1669; it is “the fertile source which brings abundance to the state and spreads it among its subjects”.

Indeed, the government’s main task in a mature market economy is to keep it free of obstacles that might stop it growing – like a bemused farmer would treat the enchanted goose: keep the foxes out so that it can go on magically laying its golden eggs.

Its achievements and answers sound authoritative and final, but what is truly most significant about them is how naïve they are – if the flow of income fails, the powerfully-bonding combination of money and self-interest will no longer be available on its present all-embracing scale, and perhaps not at all. And it must inevitably fail, as the market’s taut competitiveness demands ever-increasing productivity and thus relies on the impossibility of perpetual growth.

In the meantime, the reduction of a society and culture to dependence on mathematical abstraction has infantilised a grown-up civilisation and is well on the way to destroying it. Civilisations self-destruct anyway, but it is reasonable to ask whether they have done so before with such enthusiasm, in obedience to such an acutely absurd superstition, while claiming with such insistence that they were beyond being seduced by the irrational promises of religion. Every civilisation has had its irrational but reassuring myth. Previous civilisations have used their culture to sing about it and tell stories about it. Ours has used its mathematics to prove it.

Yet, when this relatively short-lived market-society is gone, we will miss its essential simplicity, its price mechanism, its self-stabilising properties, its impersonal exchange, the comforts it delivers to many, and the freedoms it underwrites. Its failure will be destructive.

And the end is in sight; during the early decades of the century, the market will lose its magic. It is the aim of Lean Logic to suggest some principles for the design of a replacement.

Full details of the book, reviews, footage of the late author etc here:

http://www.flemingpolicycentre.org.uk/lean-logic-surviving-the-future/