This story first appeared in Mongabay.

Editor’s note: O Canada! Welcome to the new wild west. If you liked Deepwater Horizon you will love Deep Sea Mining. This statement pretty much sums it up, “countries could have their chance to EXPLOIT the valuable metals locked in the deep sea.” Corporations love to deal with poorer, less developed countries who can do less by way of supervision because they lack greater resources and capacity.

“Like NORI, TOML began its life as a subsidiary of Nautilus minerals, one of the world’s first deep-sea miners. Just before Nautilus’s project in Papua New Guinea’s waters failed and left the country $157 million in debt, its shareholders created DeepGreen. DeepGreen acquired TOML in early 2020 after Nautilus filed for bankruptcy, the ISA said the Tongan government allowed the transfer and reevaluating the company’s background was not required.”

And mining royalties are paid to the ISA. If this doesn’t sound fishy, I don’t know what does. There never should be a question as to what a corporation’s angle is. Their loyalty always is to the stockholders.

By Ian Morse

- Citizens of countries that sponsor deep-sea mining firms have written to several governments and the International Seabed Authority expressing concern that their nations will struggle to control the companies and may be liable for damages to the ocean as a result.

- Liability is a central issue in the embryonic and risky deep-sea mining industry, because the company that will likely be the first to mine the ocean floor — DeepGreen/The Metals Company — depends on sponsorships from small Pacific island states whose collective GDP is a third its valuation.

- Mining will likely cause widespread damage, scientists say, but the legal definition of environmental damage when it comes to deep-sea mining has yet to be determined.

Pelenatita Kara travels regularly to the outer islands of Tonga, her low-lying Pacific Island home, to educate fishers and farmers about seabed mining. For many of the people she meets, seabed mining is an unfamiliar term. Before Kara began appearing on radio programs, few people knew their government had sponsored a company to mine minerals from the seabed.

“It’s like talking to a Tongan about how cold snow is,” she says. “Inconceivable.”

The Civil Society Forum of Tonga, where Kara works, and several other Pacific-based organizations have written to several governments and the International Seabed Authority (ISA) to express concerns that their countries may end up being responsible for environmental damage that occurs in the mineral-rich Clarion-Clipperton Zone, an expanse of ocean between Hawai‘i and Mexico.

“The Pacific is currently the world’s laboratory for the experiment of Deep Seabed Mining,” the groups wrote to the ISA, the U.N.-affiliated body tasked with regulating the nascent industry. As a state that sponsors a seabed mining company, Tonga has agreed to shoulder a significant amount of responsibility in this fledgling industry that may threaten ecosystems that are barely understood. And if anything goes wrong in the laboratory, Kara is worried that Tonga’s liabilities could exceed its ability to pay. If no one can pay for remediation, Greenpeace notes, that may be even worse.

“My concern is that the liability from any problem with deep-sea mining will just be too much for us,” Kara says.

Another Pacific Island state, Nauru, notified the ISA in June that a contractor it sponsors is applying for the world’s first deep-sea mining exploitation permits. The announcement triggered the “two-year rule,” which compels the ISA to consider the application within that period, regardless of whether the exploitation rules and regulations are completed by then.

Among the rules that may not be decided upon by the deadline is liability: Who is responsible if something goes wrong? Sponsoring states like Nauru, Tonga and Kiribati — which all sponsor contractors owned by Canada-based DeepGreen, now The Metals Company — are required to “ensure compliance” with ISA rules and regulations. If a contractor breaches ISA rules, such as causing greater damage to ocean ecosystems than expected, the contractor may be held liable if the sponsoring state did all they could to enforce strict national laws.

However, it’s not yet clear how these countries can persuade the ISA that they enforced the rules, nor how they can prove that they are able to control the contractors, when the company is foreign-owned. The responsibility of sponsoring states to fund potentially billions of dollars in environmental cleanup depends on the legal definitions of terms like “environmental damage” and “effective control,” which may be as murky two years from now as they are at present.

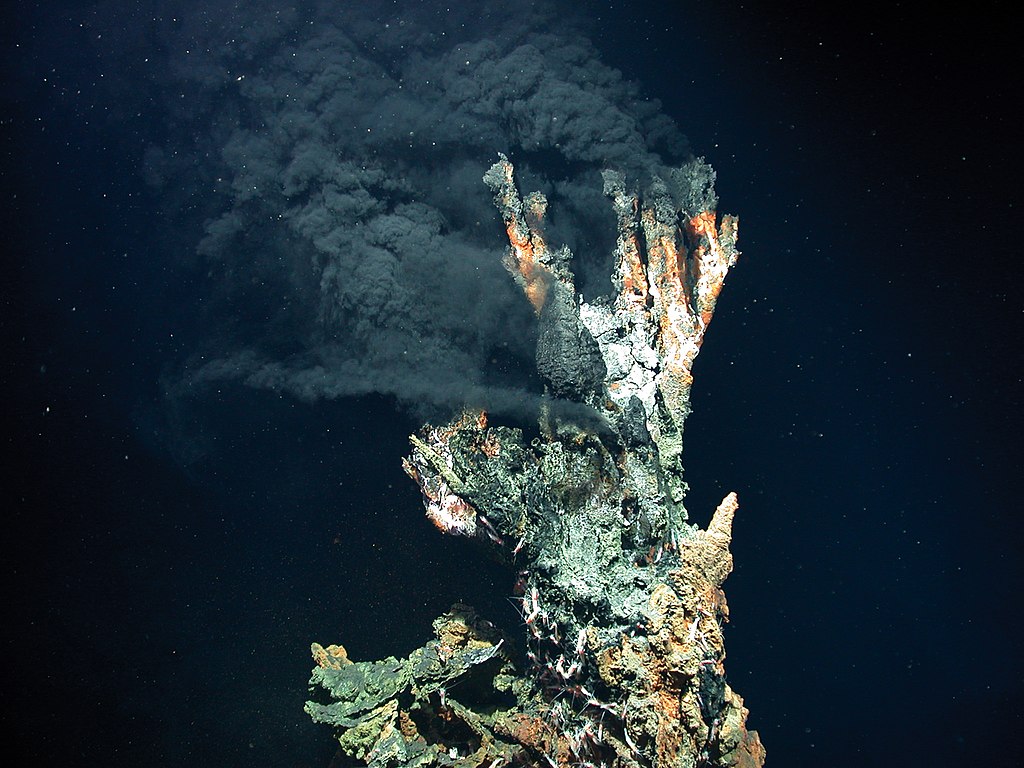

Myriad problems may occur in the mining area: sediment plumes may travel thousands of kilometers and obstruct fisheries, or damage could spread into other companies’ areas. Scientists don’t know all the possible consequences, in part because these ecosystems are poorly understood. The ISA has proposed the creation of a fund to help cover the costs, but it’s not clear who will pay into it.

“The scales of the areas impacted are so great that restoration is just not feasible,” says Craig Smith, an oceanography professor emeritus at the University of Hawai‘i, who has worked with the ISA since its creation in 1994. “To restore tens or hundreds of thousands of square kilometers would be probably more expensive than the mining operation itself.”

Nauru voices concerns

Just over a decade ago, before Nauru agreed to sponsor a deep-sea mining permit, the government worried that it was going to find itself responsible for paying those damages. The government wrote to the International Tribunal for the Law of the Sea, voicing concerns about the liability it could incur. As a sponsoring state with no experience in deep-sea mining and a small budget to support it, the delegation wanted to make sure that the U.N. did not prioritize rich countries in charting this new frontier in mineral extraction. Nauru and other “developing” countries should have just as great an opportunity to benefit from mining as other countries with more experience in capital-intensive projects, they argued.

Sponsoring states like Nauru are required to ensure their contractors comply with the law but, the delegation wrote, “in reality no amount of measures taken by a sponsoring State could ever fully ‘secure compliance’ of a contractor when the contractor is a separate entity from the State.”

Seabed mining comes with risks — environmental, financial, business, political — which sponsoring states are required to monitor. According to Nauru’s 2010 request, “it is unfortunately not possible for developing States to perform their responsibilities to the same standard or on the same scale as developed States.” If the standards of those responsibilities varied according to the capabilities of states, the Nauru delegation wrote, both poor and rich countries could have their chance to exploit the valuable metals locked in the deep sea.

“Poorer, less developed states, it was argued, would have to do less by way of supervision because they lacked greater resources and capacity,” says Don Anton, who was legal counsel to the tribunal during the decision on behalf of the IUCN, the global conservation authority.

The tribunal, issuing a final court opinion the next year, disagreed. Each state that sponsored a deep-sea miner would be required to uphold the same standards of due diligence and measures that “ensure compliance.” Legal experts generally regarded the decision well, because it prevented contractors from seeking sponsorships with states that placed lower requirements on their activities. However, according to Anton, the decision meant that countries with limited budgets like Nauru have only two choices when they consider deep-sea mining: either sponsor a contractor entirely, or avoid the business altogether.

According to the tribunal’s decision, “you cannot excuse yourself as a sponsoring state by referring to your limited financial or administrative capacity,” says Isabel Feichtner, a law professor at the University of Würzburg in Germany. “And that of course raises the question: To what extent can a small developing state really control a contractor who might just have an office in that state?”

Nauru had just begun sponsoring a private company to explore the mineral riches at the bottom of the sea Clarion-Clipperton Zone. Nauru Ocean Resources Inc. (NORI), initially a subsidiary of Canada-based Nautilus Minerals, transferred its ownership to two Nauru foundations while the founder of Nautilus remained on NORI’s board. As a developing state, Nauru said, this kind of public-private partnership was the only way that it could join mineral exploration.

Nauru discussed the tribunal’s decision behind closed doors, according to a top official there at the time, and the government sought no independent consultation, hearing only guidance from Nautilus. Two months after the tribunal gave its opinion, Nauru officially agreed to sponsor NORI.

Control

After the tribunal’s decision, the European Union recognized that writing the world’s first deep-sea mining rules to govern companies thousands of miles away would be a tall order for countries with little capacity to conduct research.

The EU, whose member states also sponsor mining exploration, began in 2011 a 4.4 million euro ($5.1 million) project to help Pacific island states develop mining codes. However, by 2018, when most states had finished drafting national regulations, the Pacific Network on Globalization (PANG) found that the mining codes did “not sufficiently safeguard the rights of indigenous peoples or protect the environment in line with international law.” In addition, in some cases countries enacted legislation before civil society actors were aware that there was legislation, says PANG executive director Maureen Penjueli.

“In our region, most of our legislation assumes impact is very small, so there’s no reason to consult widely,” she says. “We found in most legislations is that it is assumed it’s only where mining takes place, not where impacts are felt.”

For Kara, mining laws are one thing, but enforcement is another. Sponsoring states must have “effective control” over the companies they sponsor, according to mineral exploration rules, but the ISA has not explicitly defined what that means. For example, the exploration contract for Tonga Offshore Mining Limited (TOML) says that if “control” changes, it must find a new sponsoring state. When DeepGreen acquired TOML in early 2020 after Nautilus filed for bankruptcy, the ISA said the Tongan government allowed the transfer and reevaluating the company’s background was not required.

Kara questions whether Tonga can adequately control TOML, its management, and its activities. TOML is registered in Tonga, but its management consists of Australian and Canadian employees of DeepGreen. It is owned by the Canadian company. Since DeepGreen acquired TOML, the only Tongan national in the company is no longer listed in a management role.

“It’s not enough to be incorporated in the sponsoring state. The sponsoring state must also be able to control the contractor and that raises the question as to the capacity to control,” Feichtner says.

When Kara’s Civil Society Forum of Tonga and others wrote to the ISA, they argued Canada should be the state sponsor of TOML, considering TOML is owned by a Canadian firm. In response, the ISA wrote that the Tongan government “has no objection” to the management changes, so no change was needed.

“Of all the work they’re doing in the area, I don’t know whether there’s any Tongan sitting there, doing the so-called validation and ascertaining what they do. We’re taking all of this at face value,” Kara says. With few resources to track down people who live in Canada or Australia, Kara is worried that Tonga will not be able to hold foreign individuals accountable for problems that may arise.

In merging with a U.S.-based company, DeepGreen became The Metals Company and will be responsible to shareholders in the U.S. The U.S., however, has not signed on to the U.N. convention that guides the ISA, and as such is not bound by ISA regulations, the only authority governing mining in the high seas.

“What I think is pretty clear is that ‘effective control’ means economic, not regulatory, control,” says Duncan Currie, a lawyer who advises conservation groups on ocean law. “So wherever it is, it’s not in Tonga.”

The risks

On Sept. 7, Tonga’s delegation to the IUCN’s global conservation summit in France joined 80% of government agencies that voted for a motion calling for a moratorium on deep-sea mining until more was known about the impacts and implications of policies.

“As a scientist, I am heartened by their decision,” says Douglas McCauley a professor of ocean science at the University of California, Santa Barbara. “The passage of this motion acknowledges research from scientists around the world showing that ocean mining is simply too risky a proposition for the planet and people.”

Tonga’s government continues to sponsor an exploration permit for TOML. According to the latest information, Tonga and TOML have agreed that the company will pay $1.25 in royalties for every ton of nodules mined. That may amount to just 0.16% of the value of the activities the country sponsors, according to scenarios presented to the ISA by a group from the Massachusetts Institute of Technology. Royalties paid to the ISA and then distributed to countries may be around $100,000.

Nauru’s contract with NORI stipulates that the company is not required to pay income tax. DeepGreen has reported in filings to the U.S. Securities and Exchange Commission that royalties will not be finalized until the ISA completes the exploitation code. With the two-year rule, NORI plans to apply for a mining permit, regardless of when the code is written.

“The only substantial economic benefit [Nauru] might derive is from royalty payments, and these are not even specified yet. and on the other hand, it potentially incurs this huge liability if something goes wrong,” Feichtner says.

Like NORI, TOML began its life as a subsidiary of Nautilus minerals, one of the world’s first deep-sea miners. Just before Nautilus’s project in Papua New Guinea’s waters failed and left the country $157 million in debt, its shareholders created DeepGreen.

“I am afraid that Tonga will be another Papua New Guinea,” Kara says. “If they start mining and something happens out there, we don’t have the resources, the expertise, because we need to validate what they’re doing.”

DeepGreen has said it is giving “developing” states like Tonga the opportunity to benefit from seabed mining without shouldering the commercial and technical risk. DeepGreen did not respond to Mongabay’s requests for comment.

“I’m still trying to figure out their angle. Personally, I think DeepGreen is using Pacific islanders to hype their image. I’m still thinking that we were never really the target. The shareholders have always been their target,” Kara says.

She says she doubts the minerals at the bottom of the ocean are needed for the world to transition away from fossil fuels. In a letter to a Tongan newspaper, Kara wrote, “Deep-sea mining is a relic, left over from the extractive economic approaches of the ’60s and ’70s. It has no place in this modern age of a sustainable blue economy. As Pacific Islanders already know — and science is just starting to learn — the deep ocean is connected to shallower waters and the coral reefs and lagoons. What happens in the deep doesn’t stay in the deep.”